Now that we’re half way through 2022 we can take a look at our Real Estate Market and what we’re starting to see is transition. This is what we’re seeing consistently throughout Colorado’s Front Range. The fact of the matter is that Northern Colorado consists of many different hyper-local markets though. So with that in mind let’s take a look at how our local market right here in Troutman Park compares to previous years.

Here is what Troutman Park’s Real Estate market has done through the 1st half of 2022 and compare it to the same time during other recent years. Here are the numbers:

2022 Q1-Q2 – 24 homes sold for $12,775,100. They ranged from $407,500 – $752,00 at an average of $532,295

2021 Q1-Q2 – 31 homes sold for $14,614,420. They ranged from $371,000 – $630,000 at an average of $471,432

2020 Q1-Q2 – 30 homes sold for $11,727,425. They ranged from $325,000-$507,000 at an average of $390,914

2019 Q1-Q2 – 33 homes sold for $12,724,583. They ranged from $320,000-$477,900 at an average of $385,593

2018 Q1-Q2 – 24 homes sold for $8,813,900. They ranged from $290,000-$465,000 at an average of $367,245

2017 Q1-Q2 – 25 homes sold for $8,594,519. They ranged from $257,500-$443,000 at an average of $343,780

2016 Q1-Q2 – 27 homes sold for $8,645,100. They ranged from $205,000-$436,000 at an average of $327,000

2015 Q1-Q2 – 36 homes sold for $10,185,745. They ranged from $218,325-$355,000 at an average of $282,937

Last year at this time there were 10 homes in the neighborhood that sold at $500,000 or more (3 of those were between $601,000 and $630,000). In the 1st half of 2022 there were 16 homes in Troutman Park that sold for more than half a million. Our neighborhood also saw a new all time high in value when 319 Mapleton Ct sold for $752,000 on June 16. The average price in Troutman Park is up 13% over the 1st half of last year’s average.

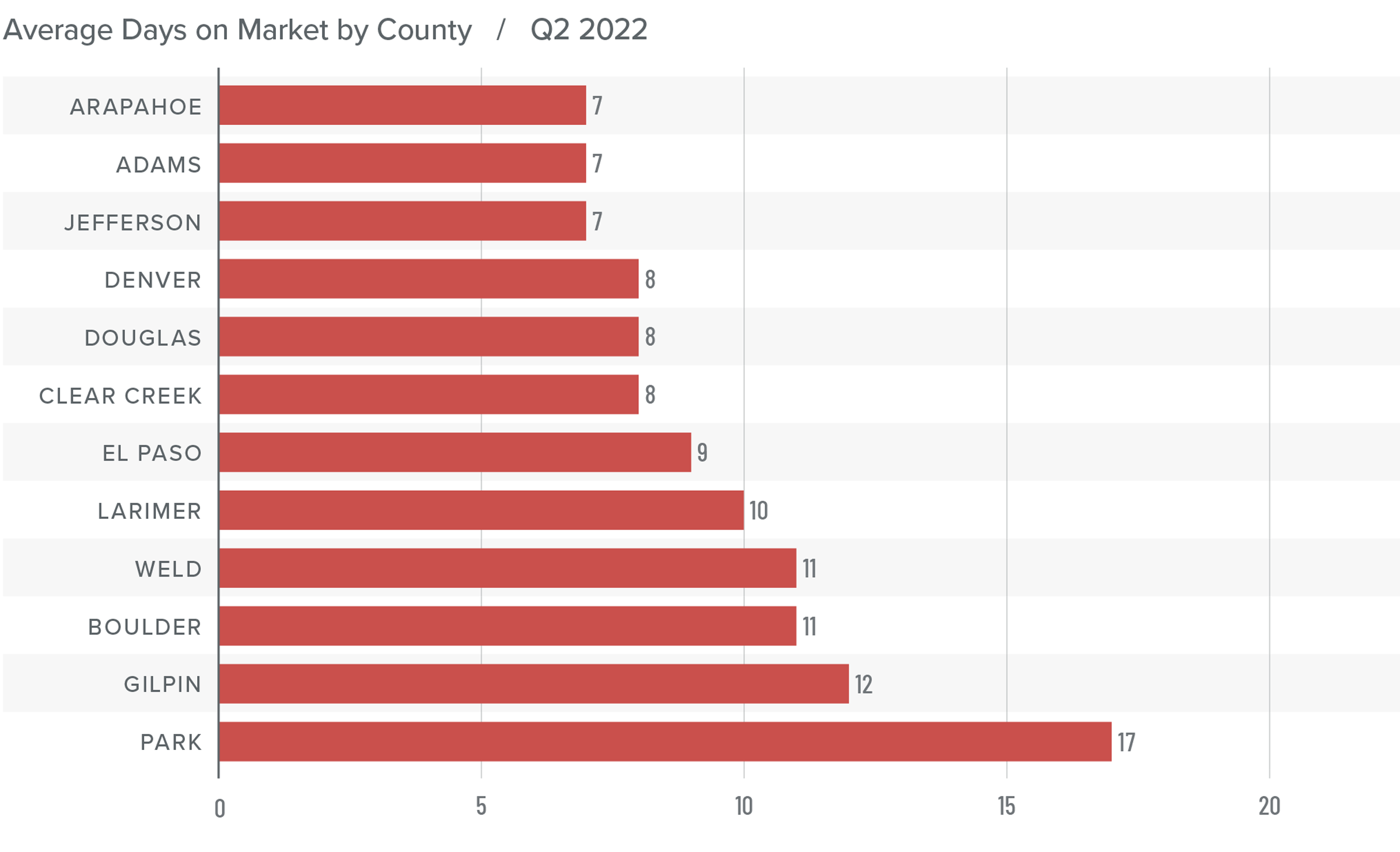

The average days on the market before going under contract for Troutman Park properties is 8 days for the 1st half of 2022. That’s up just one day from last year at this time. We’ll likely see that number go up a few days in the 2nd half of the year however.

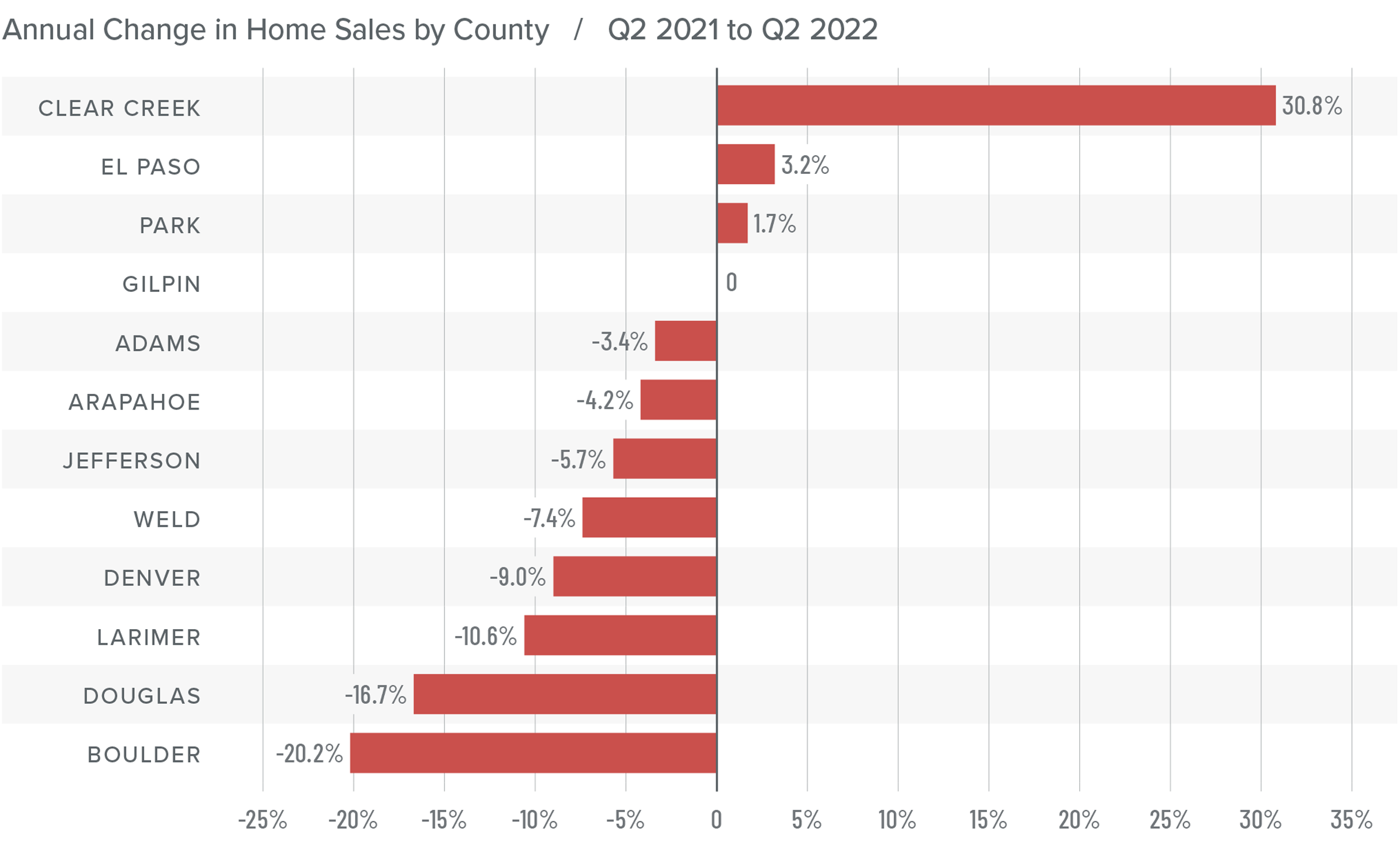

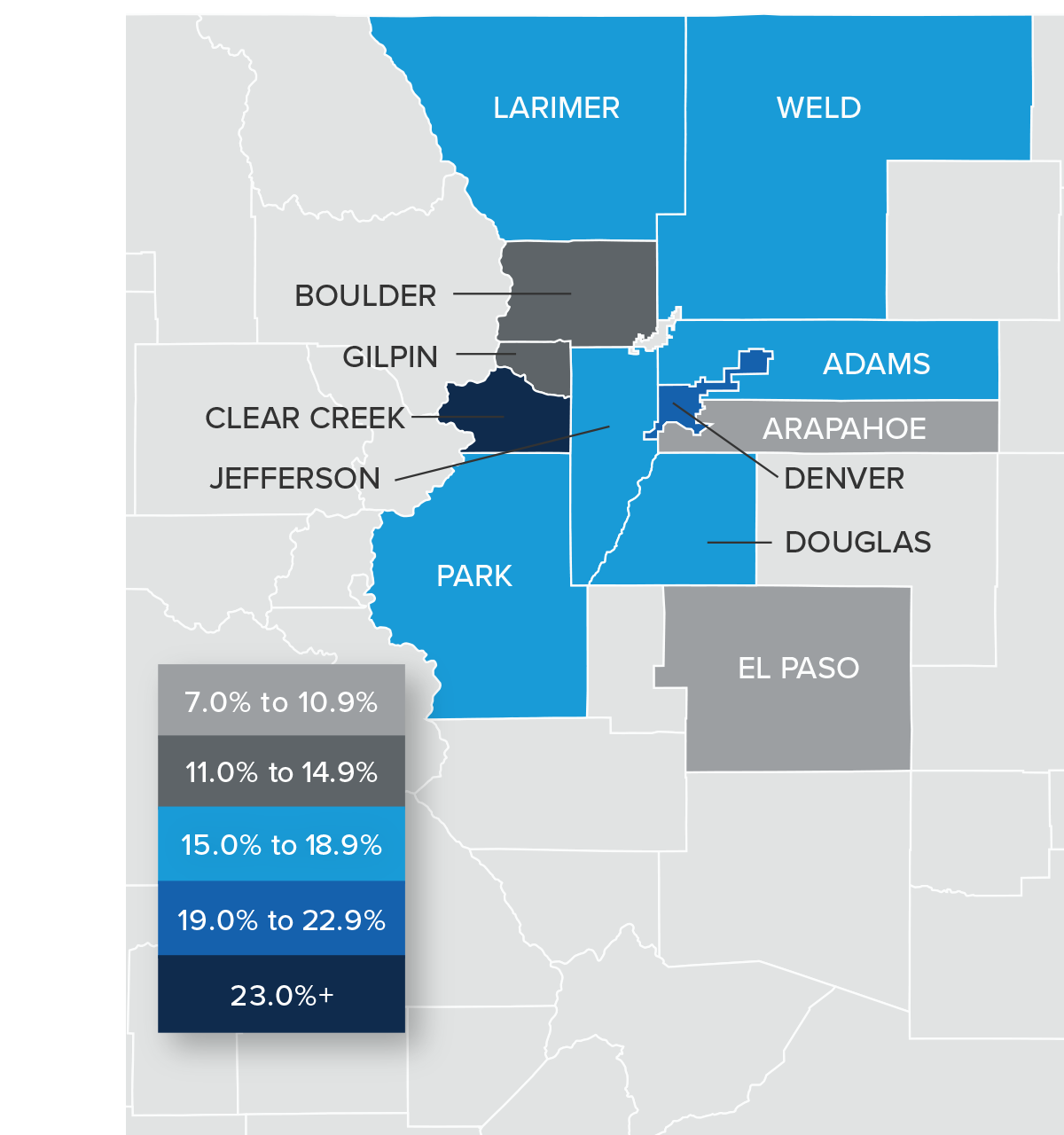

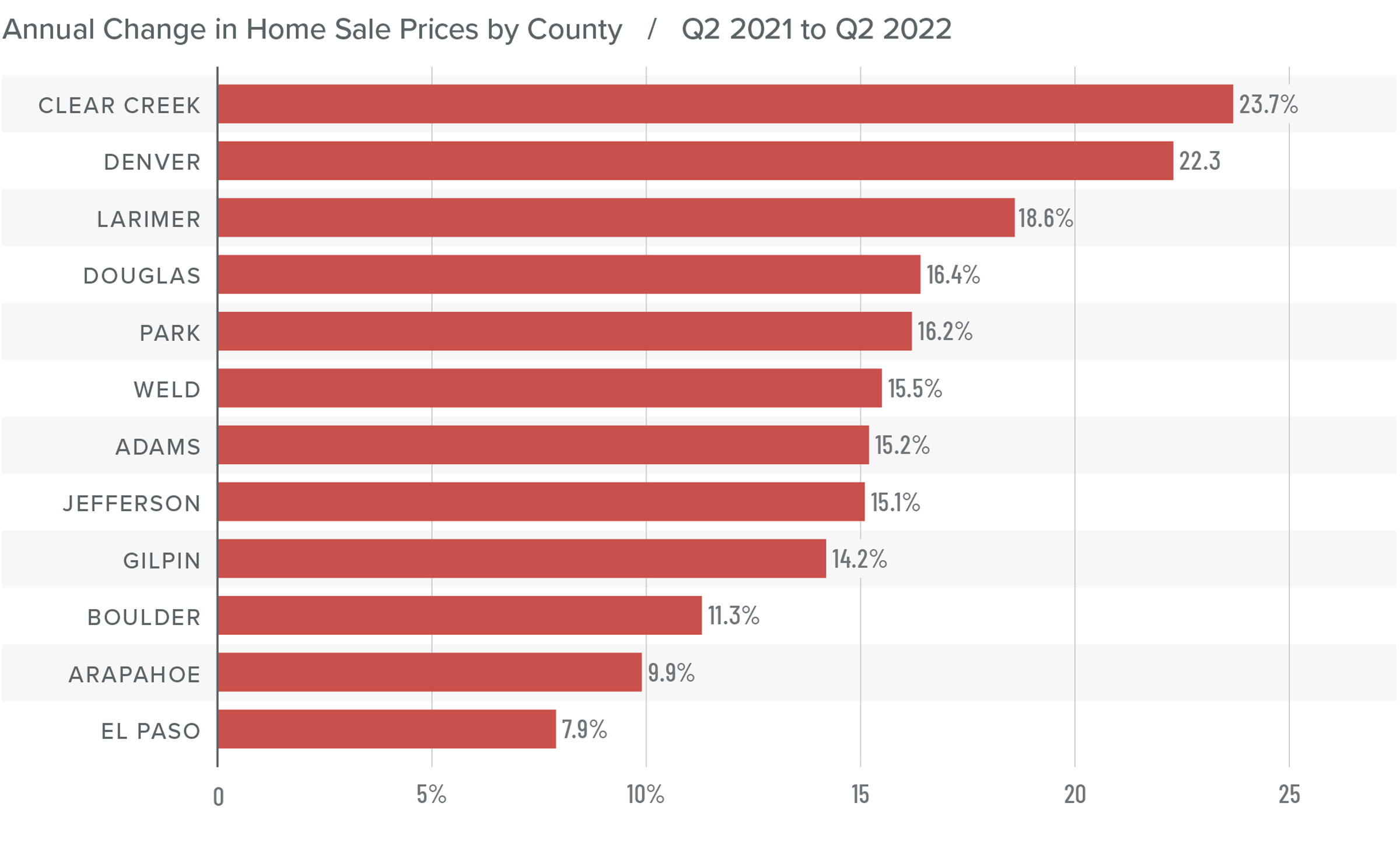

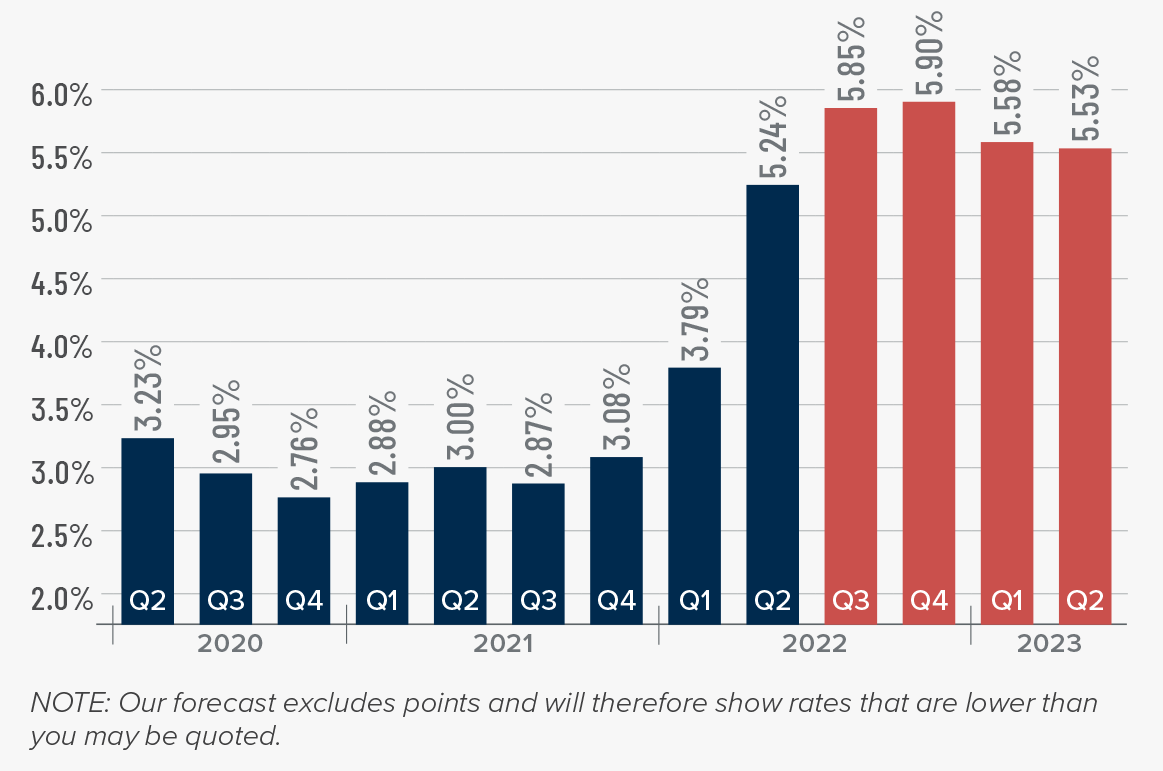

What we’re seeing across all Colorado’s Front Range is a transition in our real estate market. We have gone from an all time low of inventory (2 weeks supply) in the 1st quarter of the year to what we see as 1.5 months supply now. When the interest rates started to rise in March some buyers started to head to the sidelines. When May and June rolled around we also started to notice a significantly higher number of homes for sale on the market.

For those who worry that we’re on the edge of a bubble keep in mind that economist say there is not a chance of values dropping until there are 6 or months of inventory on the market. Right now we are at 1.5 months supply of inventory. The tides are starting to change though and sellers don’t have nearly as much leverage in negotiations right now compared to last year or the beginning of 2022. The nicely remodeled “Move In Ready” homes may still have more than 1 offer competing for them. It will probably be more like a 2-4 offer situation now though compared to places that were seeing somewhere in the neighborhood of up to 20 offers earlier in the year.

The other factor we notice right now is something we see most every year. That’s the seasonal slow down in buyer activity from July through early September. One reason we see this is the families that are putting their search on the back burner while on vacation and then getting ready for back to school.

The end result means sellers are still in demand but there is a lot more opportunity for buyers now as there isn’t nearly as much competition as there was at the beginning of the year. Some buyers may be able to negotiate having sellers pay concessions towards buying down the interest rate which can be a big Win/Win situation.

If you have questions about anything or if you’re curious about what your home might be worth, just let me know. I grew up here in Fort Collins, I’ve worked in Real Estate since 2002. I live right here in Troutman Park and I’m always happy to share.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link